31+ does mortgage pay property tax

Lock Your Rate Today. Web Why do property taxes go up when you pay off your mortgage.

Hecht Group Do You Pay Property Taxes And Pmi

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

. Lets say your home has an assessed value of 100000. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able.

Web The death of a spouse is an emotional and trying time. For Homeowners Age 61. If you qualify for a.

These rates are usually based on how much. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Apply Get Pre-Approved Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Web May 31 2022. If your county tax rate. This calculation only includes principal and interest.

Save Real Money Today. Get A Free Information Kit. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Get a Free Information Kit. Web ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX Lets say your home has an assessed value of 100000.

Ad Founded in 1909 Mutual Of Omaha is a Company You can Trust. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. For Homeowners Age 61.

If you do roll your property tax payments into your mortgage payments. Ad Compare the Best Home Loans for February 2023. Get Instantly Matched With Your Ideal Mortgage Lender.

This is calculated by first tallying the value of. For example if you got an 800000 mortgage to buy a. Lock Your Rate Today.

Web If the property you are relinquishing has a mortgage you will have to pay it off when you sell. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Compare the Best Home Loans for February 2023.

How Much Tax Should I Have Paid. Apply Get Pre-Approved Today. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Web Each property owner in the municipality pays a proportion of that 2000 based on their propertys assessed value. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The property tax rate that you pay at the local county and state level is often referred to as the millage rate or mill rate. Web 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage.

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. If your county tax rate is 1 your. However to receive the full tax deferral of a 1031 exchange youll need to take out a.

Ad Compare the Best Reverse Mortgage Lenders. Web All you have to do is take your homes assessed value and multiply it by the tax rate. When you pay off your mortgage you stop paying interest and lose the ability to write off that expenseThis.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Added to this difficult time often is the additional stress of not fully understanding what should or should not be done with your.

Failure To Pay Property Taxes Is A Default Of Your Mortgage

Property Tax Your Mortgage Credit Com

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

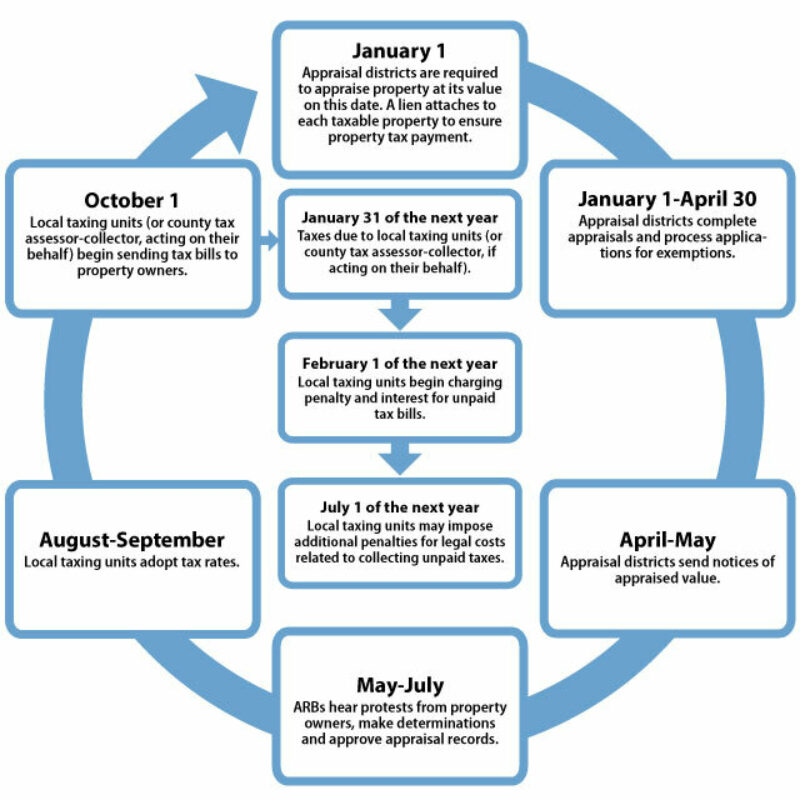

All About Property Taxes When Why And How Texans Pay

My Mortgage Escrow Doesn T Pay Property Tax On Time R Mildlyinfuriating

Paying Property Taxes Through Mortgage Escrow How It Works

Property Taxes Should You Pay For It Or Your Lender

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kawaii Finance Digital Widgets Expansion Pack 18 Cute Etsy

Mortgage Broker In Birkdale Thornside Wakerley Mortgage Choice

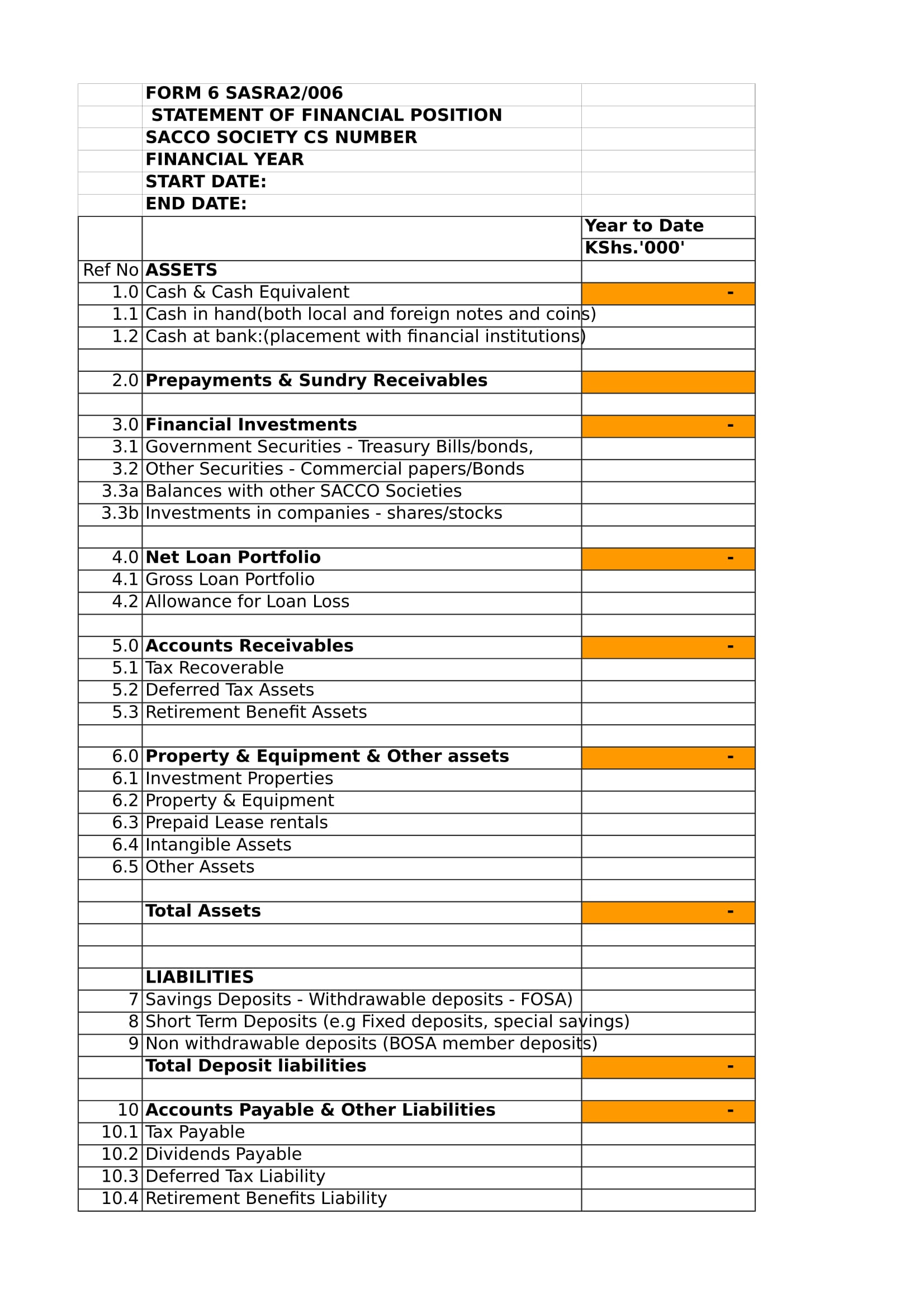

Free 31 Statement Forms In Excel Pdf Ms Word

Are Property Taxes Included In Mortgage Payments Sofi

What Is Mortgage Interest Deduction Zillow

All About Property Taxes When Why And How Texans Pay

Is Property Tax Included In My Mortgage Moneytips

Hecht Group Do You Pay Property Taxes And Pmi

Complete Guide To Selling A Probate Or Inherited House